ScreenerBot

Your Personal Solana Trading Assistant

✓ Free to download • ✓ Runs locally • ✓ Your keys stay yours

Tired of missing trades while you sleep? ScreenerBot monitors the Solana market 24/7, discovers new tokens, and executes your strategy automatically. Built with Rust for blazing speed.

Why Traders Choose

ScreenerBot

Professional-grade trading tools running locally on your machine.

No subscriptions, no API keys, no monthly fees.

Speed That Actually Matters

In crypto, seconds = money. ScreenerBot is built with Rust (same as Solana itself) so it calculates prices in milliseconds, not seconds. While others are still loading, you're already in the trade.

Real Prices, Not Delayed Data

Online tools show 30-60 second old prices. That's ancient in crypto. ScreenerBot reads directly from Solana's liquidity pools on your computer, giving you the actual price, right now. No middleman delays.

Everything in One Dashboard

Stop juggling 10 browser tabs. Security scores, liquidity, price charts, transaction history, all in one clean interface. DexScreener + GeckoTerminal + RugCheck + Jupiter data, unified and always up to date.

AI-Powered Scam Detection

LLM integration analyzes tokens for scam patterns beyond numerical filters. Catch suspicious metadata, holder manipulation, and rug pull indicators automatically. Use free providers like Groq or premium models like GPT-4o for maximum accuracy.

Complete Token Intelligence Pipeline

ScreenerBot operates a multi-layer data pipeline that discovers tokens, analyzes security risks, applies intelligent filters, monitors prices, and executes trades, all running automatically every minute.

Think of it as a complete intelligence system: scouts find new tokens → security experts assess risks → filters apply your criteria → price monitors track movement → you trade with complete information.

Layer 1: Token Discovery

Finding new tokens every 60 seconds from multiple sources

DexScreener

GeckoTerminal

RugCheck

Jupiter

CoinGecko

DefiLlama

Layer 2: Security Analysis

Deep risk assessment before you trade

RugCheck Security Reports

Layer 3: Intelligent Filtering

Apply your criteria to passed tokens

DexScreener Filters

- • Minimum liquidity thresholds

- • Volume requirements (5m/1h/6h/24h)

- • Transaction activity minimums

- • Market cap ranges

- • FDV limits

- • Price change criteria

- • Token metadata validation

GeckoTerminal Filters

- • Aggregated liquidity checks

- • Volume validation

- • Market cap ranges

- • Price change limits

- • Pool quality metrics

RugCheck Filters

- • Security score thresholds

- • Authority requirement (mint/freeze)

- • Holder concentration limits

- • LP lock verification

- • Risk level assessment

- • Insider trading detection

The filtering engine evaluates every token against all criteria from all sources simultaneously. You can configure thresholds for liquidity, volume, market cap, security scores, and more to create your perfect token screening system.

Layer 4: Price Monitoring

Real-time prices from pool reserves + market data APIs

Direct Pool Price Calculation

For tokens with valid SOL pair pools, ScreenerBot reads pool reserves directly from the blockchain and calculates prices locally. No API delays—just pure math on real-time data.

DexScreener Market Data

GeckoTerminal Market Data

By combining multi-source discovery, comprehensive market data, and deep security analysis, ScreenerBot gives you the most complete view of Solana's token ecosystem with intelligent filtering that lets you find exactly the tokens you want to trade.

Professional TradingInterface

Response

<50ms

Updates

Live

Platform

Native

Click to Zoom

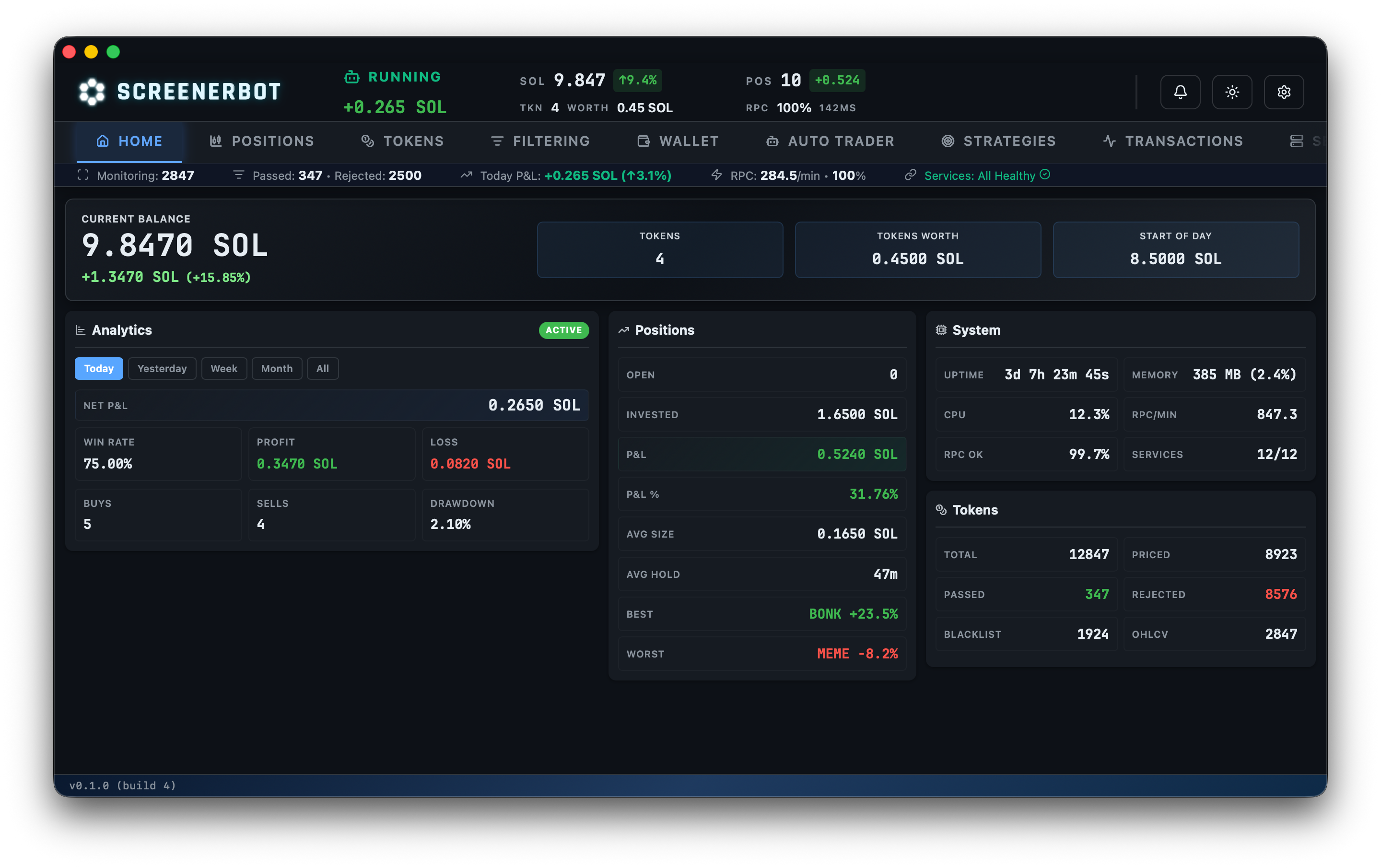

Dashboard Overview

Real-time wallet balance, active positions, and market intelligence at a glance

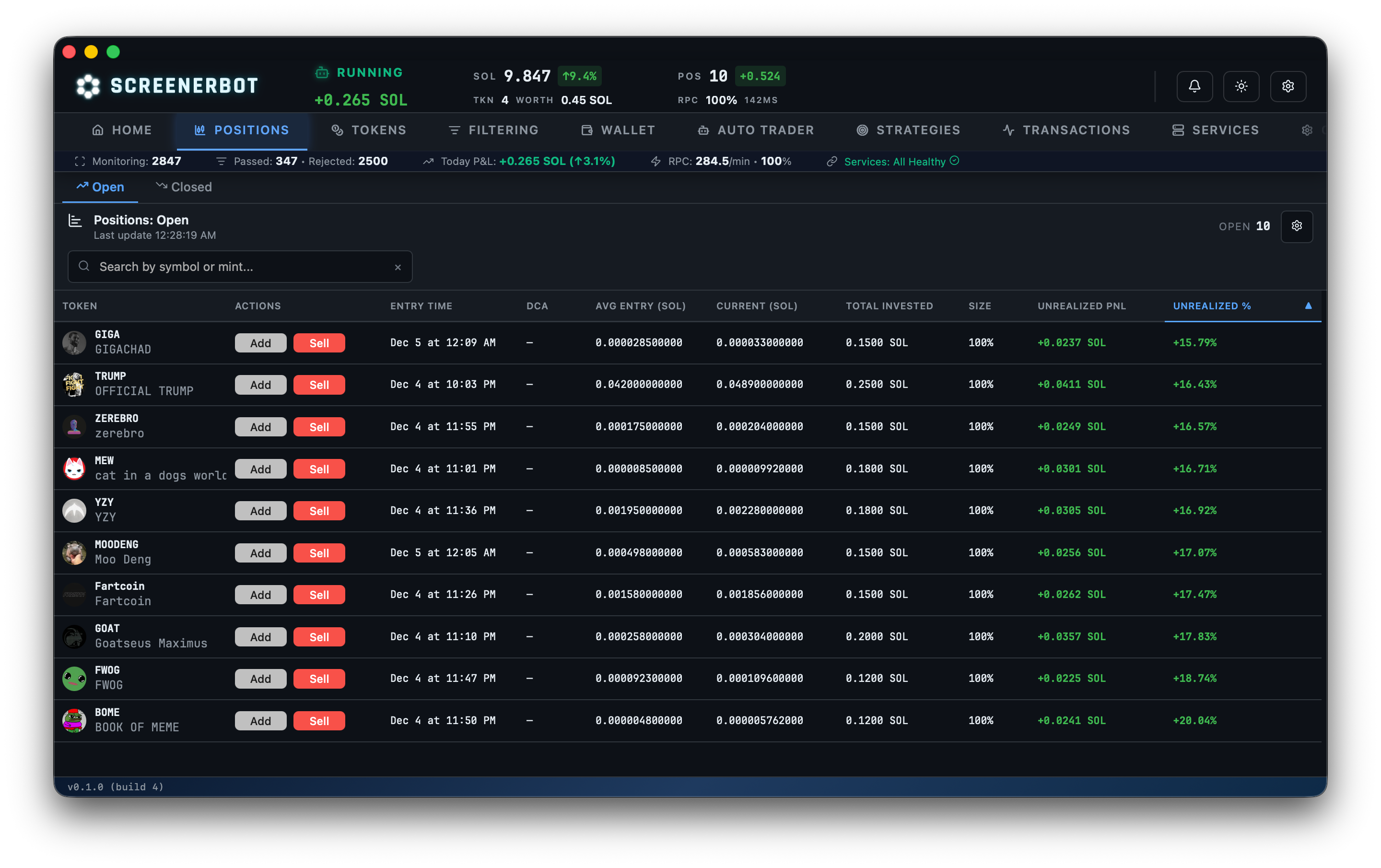

Open Positions

Track entry prices, P&L, and ROI in real-time

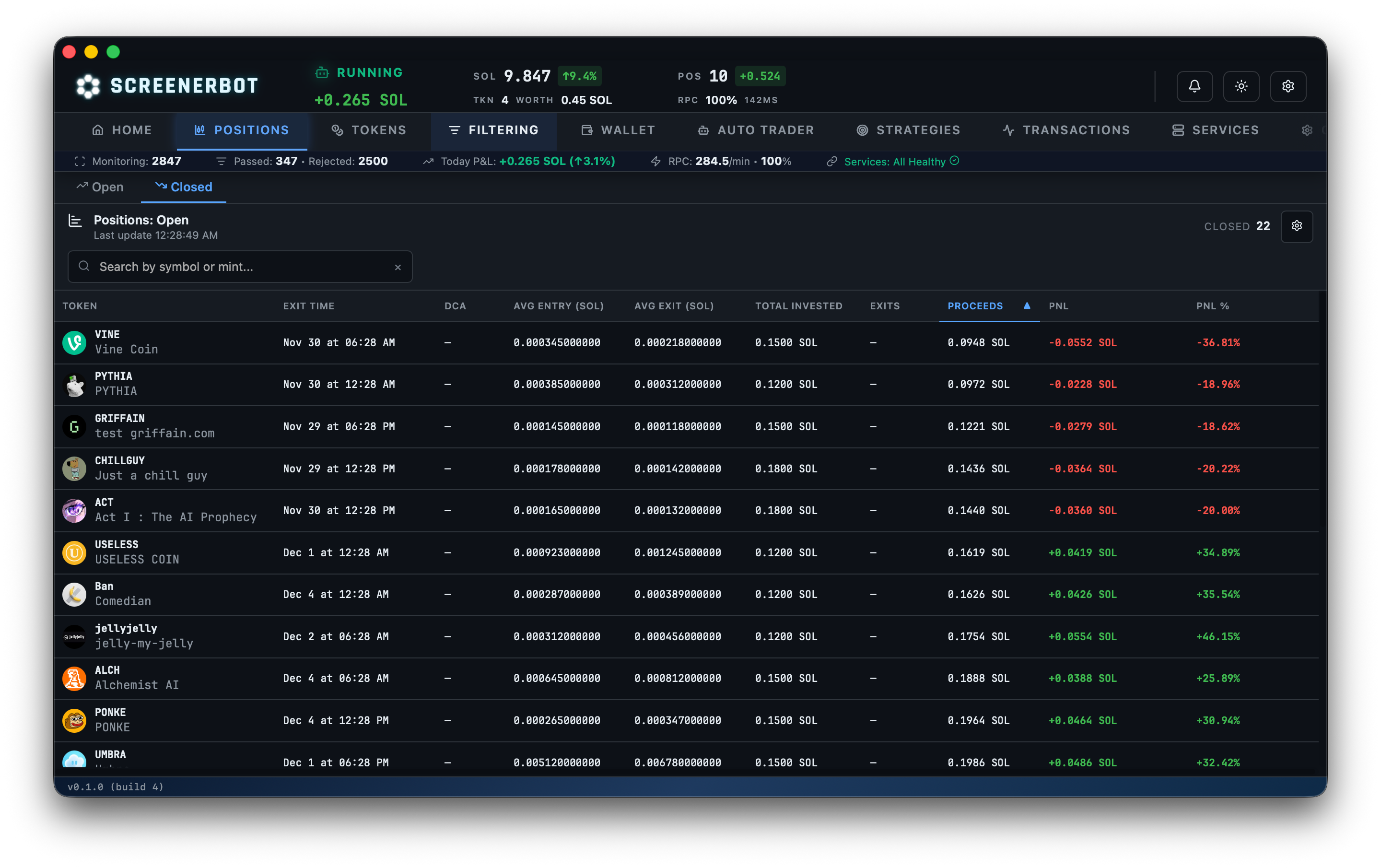

Position History

Complete records of all closed trades with analytics

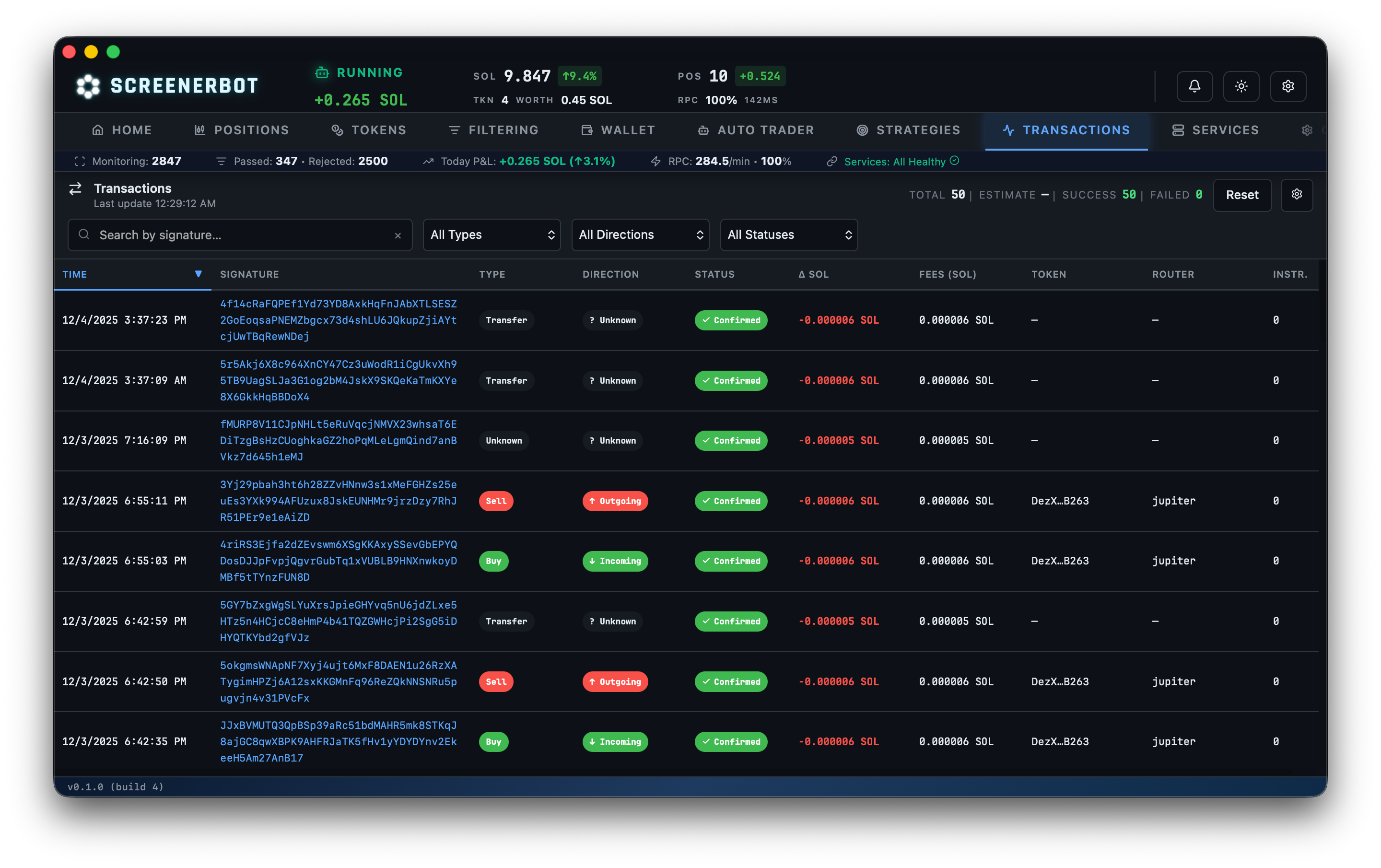

Transaction Monitor

Live feed of wallet transactions with DEX classification

Why Accurate Prices Matter

Imagine buying a token and realizing the "price" you saw was actually from 60 seconds ago. In crypto, that's an eternity. ScreenerBot calculates prices directly from liquidity pools, instantly and locally on your computer.

Online Aggregators

- Prices delayed by 30-60 seconds (their servers update slowly)

- Caching adds even more lag

- By the time you see a price, the market has moved

- Miss entry/exit opportunities constantly

ScreenerBot (Local)

- Updates every ~5 seconds directly from blockchain

- Calculates price on your computer in <50ms

- See the real price, not what it was a minute ago

- Enter and exit at the actual market price

This becomes critical with micro-caps and volatile tokens where prices change every second

Smart Exit Strategies (Set & Forget)

The hardest part of trading? Knowing when to exit. These automated strategies handle it for you: no emotional decisions, no staying glued to your screen, no regrets.

Trailing Stop Loss

Ride the wave up, lock in profits when it turns

Automatically adjusts your exit price as the token climbs, securing maximum gains without staring at charts.

ROI Take Profit

Set your finish line and let the bot cross it

Perfect for disciplined trading. Decide your profit goal in advance and the bot executes it instantly when reached.

Bag Holder Protection

Don't get stuck with dead tokens forever

Automatically sells positions that are bleeding out after a set time. Frees up your SOL for the next opportunity.

Build Custom Trading Strategies

No coding required. Click, configure, and combine. ScreenerBot's visual strategy builder lets you create sophisticated entry and exit logic using real-time market data and technical indicators.

Visual Strategy Builder

No code, no confusion. Browse 9+ condition types in an organized catalog, click to add them to your strategy, and configure with simple forms. Combine conditions with AND/OR/NOT operators to create complex logic.

Multi-Timeframe Analysis

Analyze tokens across 7 timeframes (1m to 1d) simultaneously. Set your strategy to 5m but check volume spikes on 1m candles, each condition can use a different timeframe for maximum flexibility.

Separate Entry & Exit Logic

Different rules for buying and selling. Enter on volume spikes above 50 SOL liquidity, exit when price breaks below 20-period MA. Each strategy type has dedicated conditions optimized for its purpose.

Performance Metrics

Track every strategy's win rate, execution time, and signal accuracy. See exactly which conditions trigger most often and optimize your logic based on real results, not guesswork.

9+ Technical Conditions at Your Fingertips

Example Strategy: Momentum Breakout

A real strategy you can build in under 2 minutes

This strategy enters on confirmed breakouts with high volume and safe liquidity, then exits when momentum reverses or price falls below the moving average. All evaluated in real-time with <50ms execution.

Test strategies in real-time before deploying. See exactly which tokens match your criteria.

Speaking Solana's Native Language: Rust

Here's something cool: Both Solana and ScreenerBot are built with the same programming language, Rust. It's like they speak the same native tongue.

Why does this matter? Rust is known for being incredibly fast (as fast as C++) while preventing the crashes and bugs common in other languages. Perfect for a trading bot that needs to be lightning-quick and rock-solid reliable.

Never Crashes on You

Ever had software crash mid-task? Frustrating, right? Rust eliminates those crashes before the program even runs. It's like having a super-strict spell-checker that won't let you save a document with errors.

Lightning Fast Performance

Languages like Python or JavaScript are easy to learn, but they're slow. Rust is as fast as C++, the gold standard for performance, which means calculations happen in milliseconds, not seconds.

Does Everything at Once

Imagine trying to watch five screens, answer calls, and take notes simultaneously, chaos, right? Rust lets ScreenerBot juggle hundreds of tasks simultaneously without dropping the ball.

Why This Matters for Trading

- Catch opportunities faster: While Python bots are still calculating, you're already in the trade

- Never miss an exit: No lag means your stop-losses and take-profits trigger exactly when they should

- Run worry-free: Set it and forget it, the bot doesn't crash or slow down over time

Production-Ready Reliability

- Simple installation: Standard installers for your platform, easier updates and system integration

- Consistent performance: No random slowdowns during high-volume trading

- Battle-tested: Running 24/7 in production with 99.9% uptime

By using the same language as Solana itself, ScreenerBot achieves speed, stability, and safety that would be impossible with traditional scripting languages like Python or JavaScript.

Complete Trading Suite

8 powerful modules working together seamlessly

Live Portfolio View

Watch your positions update in real-time. P&L, ROI, entry prices, all at a glance

Smart Position Tracking

Automatic break-even calculation, price alerts, and performance history for every trade

Rug Pull Protection

RugCheck integration flags risky tokens before you buy. See holder distribution, LP locks, and red flags

AI Scam Detection

Large Language Models analyze tokens for scam patterns, suspicious metadata, and rug indicators automatically

Complete P&L Tracking

Know your exact profit after fees. Track realized vs unrealized gains across all positions

Set It & Forget It

Configure your entry/exit rules once. The bot executes 24/7 while you sleep

Change Anything Anytime

Hot-reload your config without restarting. Adjust strategy on the fly as market changes

Telegram Control

Monitor positions and execute trades from your phone. Instant notifications with action buttons

Built for Every Trading Style

Whether you're scalping micro-caps or managing a portfolio, ScreenerBot adapts to your strategy

Active Traders

Execute faster than humanly possible. Enter and exit trades in milliseconds while others are still loading their browser.

Part-Time Traders

Don't have time to watch charts? Set your trailing stops and take-profit levels. The bot trades while you live your life.

Position Builders

DCA automatically into positions. Buy the dip without emotional hesitation. Build positions systematically over time.

Portfolio Managers

Track 50+ tokens without losing your mind. See everything in one dashboard instead of juggling dozens of browser tabs.

Simple, Fair Pricing

ScreenerBot is free to download. Only pay 0.5% via Jupiter when you swap.

Swaps routed through Jupiter V6 with 0.5% referral fee. Always see exact costs before confirming.

Why Run It on Your Own Computer?

Cloud platforms are convenient, but they come with risks. ScreenerBot gives you something better: complete control, maximum speed, and true security.

Your Keys, Your Coins

Your wallet stays on your computer, period. ScreenerBot never touches your private keys, never stores your funds. Zero risk of platform hacks or "oops, we lost everyone's money."

Lightning-Fast Execution

No waiting for a server halfway across the world to process your request. Everything runs locally on your computer, connected directly to Solana. The result? Trades execute in milliseconds, not seconds.

Simple, Honest Pricing

Download is free. Using the bot is free. You only pay a tiny 0.5% fee when you actually trade (via Jupiter). No subscriptions, no hidden costs, no surprises.

How it works:

Your Computer → Your Wallet → Solana Blockchain → DEX Smart Contracts

No middlemen, no platforms, no trust required

Complete Trust, Zero Compromise

We connect to our servers for two things only: checking for updates and fetching featured tokens. No personal data is ever sent.

Our philosophy: Your data stays on your computer. We only provide the software.

Start Trading in 3 Minutes

No complex setup. No coding required. Download, configure, trade.

Download & Install

Use the installer for your OS (Windows, macOS, or Linux). Standard installation packages provide easier updates and follow platform conventions.

Connect Your Wallet

Import your existing wallet or create a new one. Your private key is encrypted and stored locally. We never see it.

Configure & Trade

Set your filters, define your strategy, and let the bot work. Start with small amounts while you learn the ropes.

Common Questions

Everything you need to know before getting started

QIs ScreenerBot actually free?

Yes! Download and use are completely free. The only cost is a 0.5% fee on swaps, which is deducted automatically via Jupiter. No subscriptions, no hidden fees, no catch.

QIs my wallet safe?

Your private key stays encrypted on your computer. ScreenerBot never sends your keys anywhere. All trades are signed locally. Your funds are always safe because they stay in YOUR wallet—we have no access to them.

QDo I need coding knowledge?

Not at all! The dashboard is visual and intuitive. Configure filters with dropdowns, set trading rules with simple forms, and build strategies by clicking to add conditions. If you can use DexScreener, you can use ScreenerBot.

QHow do I get started safely?

Start with small trade amounts to test your strategy with real market conditions. All your settings and positions are saved locally, so you can tweak and refine your approach as you learn.

QWhat if my internet disconnects?

Your positions and settings are saved locally. When you reconnect, the bot picks up right where it left off. No data loss, no orphaned trades.

QWhich DEXs are supported?

11 pool protocols across 6 major Solana DEXs: Raydium (CPMM/CLMM/Legacy), Orca Whirlpool, Meteora (DLMM/DAMM/DBC), PumpFun (AMM/Legacy), Fluxbeam, and Moonit. Swaps route through Jupiter for best prices.

QDo you collect my data?

No. ScreenerBot runs 100% locally on your computer. The only server connection is a GET request to check for updates—no data is sent. All market data comes from public APIs (DexScreener, GeckoTerminal, RugCheck) and transactions go directly to Solana via your RPC.

QWhat is the minimum position size?

The minimum position size is 0.005 SOL (about $1-2). This means you can test strategies with minimal risk. Note: opening a position at minimum size starts at around -5% due to fees, but this is just $0.05-0.10 in real terms, the safest way to learn.

QWhy does ~0.002 SOL stay in my wallet when I trade?

Solana requires a small rent deposit (~0.002 SOL) to create a token account (ATA) for each new token you hold. This rent is NOT lost—it returns to your wallet when you sell and close the account. ScreenerBot auto-cleans empty ATAs every 5 minutes to reclaim rent.

Still have questions?

Read the full documentationJoin Traders Taking Control

Stop relying on centralized platforms. Run your own trading infrastructure. Your computer, your keys, your profits.

Stop Missing Trades.

Start Automating.

Every minute you spend watching charts is a minute you could be living. Let ScreenerBot watch the market while you do literally anything else.

Windows • macOS • Linux • Free forever • 0.5% swap fee only